How Your Exploration is Risk is Lowered

“Exploration is really the essence of the human spirit”

– Frank Borman

Exploration is what one does either to first identify an economic mineral resource or after it has already been identified, to find additional resources.

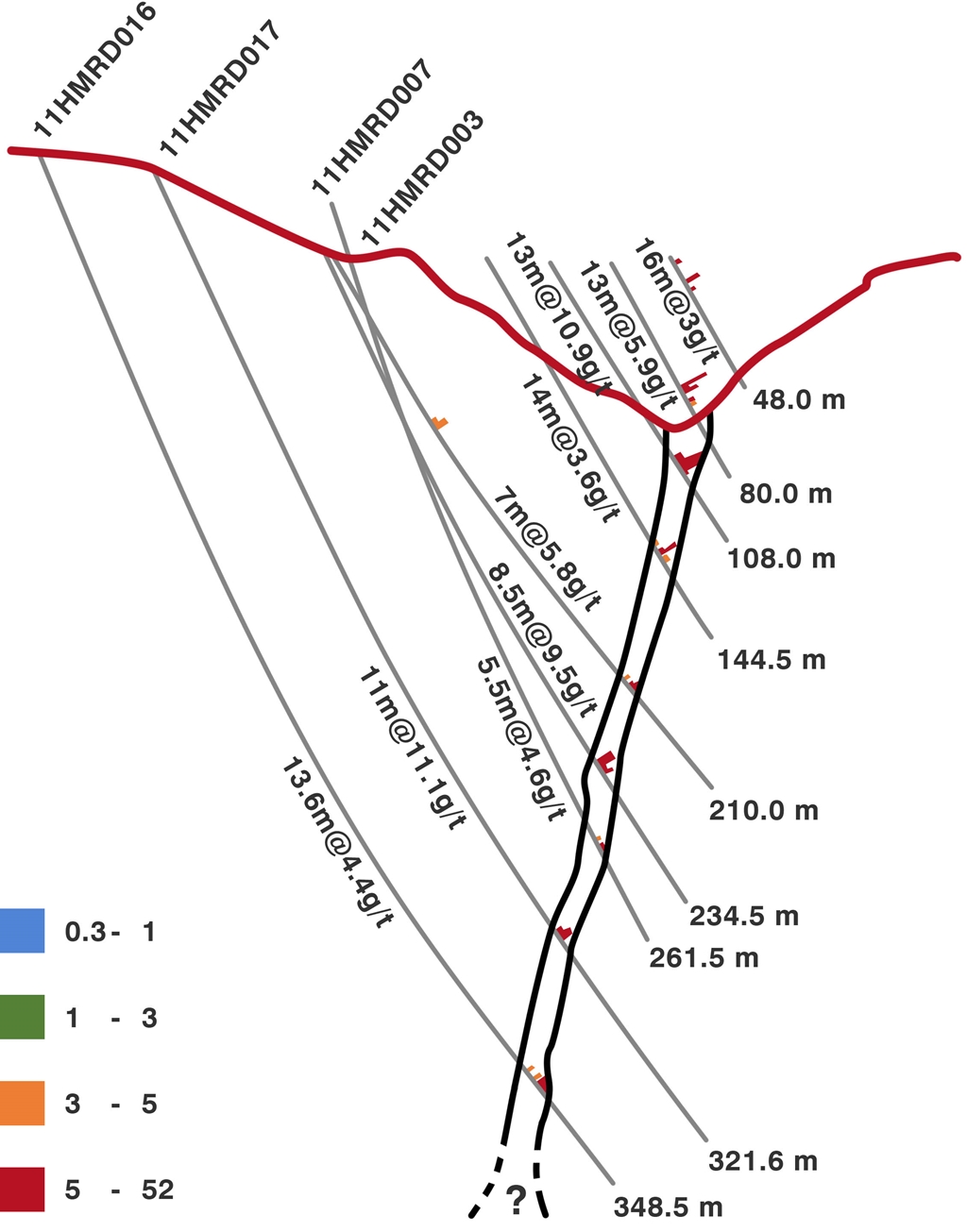

Exploration is done in a systematic fashion from the macro to the micro scale. First, selection of a target area based on tectonic trends and host rocks, then stream sediment sampling, grid-based soil sampling, geological mapping, rock chip sampling, trenching and finally drilling (as in the gold drilling cross-section below). If one already has the target area, then one can skip the first two or three phases.

Many of the exploration projects I worked on were around existing mines and closed mines (” brownfield”).

If you are starting fresh in a new area where little or no exploration has been done before this is known as “greenfield” exploration.

Brownfield exploration is much lower risk because it occurs around existing deposits but greenfield arguably has potential for higher rewards because completely new discoveries can be made although your chances of discovering anything are much lower.

My experience at Mount Muro and Tembang gold projects in Indonesia, Asacha and Veduga gold projects in Russia, and at Star Zinc and Mimbula copper project in Zambia suggests that there are very good brownfield opportunities once you get the timing right for acquisition. The project selection must be right; you will have to kiss a lot of frogs to meet one or two princes. In Zambia I looked at 103 projects before recognizing the potential at Mimbula and another project called Star Zinc, which we signed an Option on but unfortunately did not have the funds to execute.

Exploration drilling results for an unnamed gold project

Timing is about doing deals for projects when metal prices are low or other market factors like government instability having taken hold for a period meaning traditional license holders have exited.

However this is not without risks because it is hard to time the bottom of the market, hard to know if or when political stability is returning and hard to raise funds at the bottom of the metal price cycle and for locations that you think are emerging from a period of political turmoil.

Comments are closed.