Who really needs a Bankable Feasibility Study?

A feasibility study analyses a planned project to determine whether it is technically possible. It covers the potential trade, operational, financial, and environmental impact. A feasibility study should provide truthful information upon which a sound decision can be made.

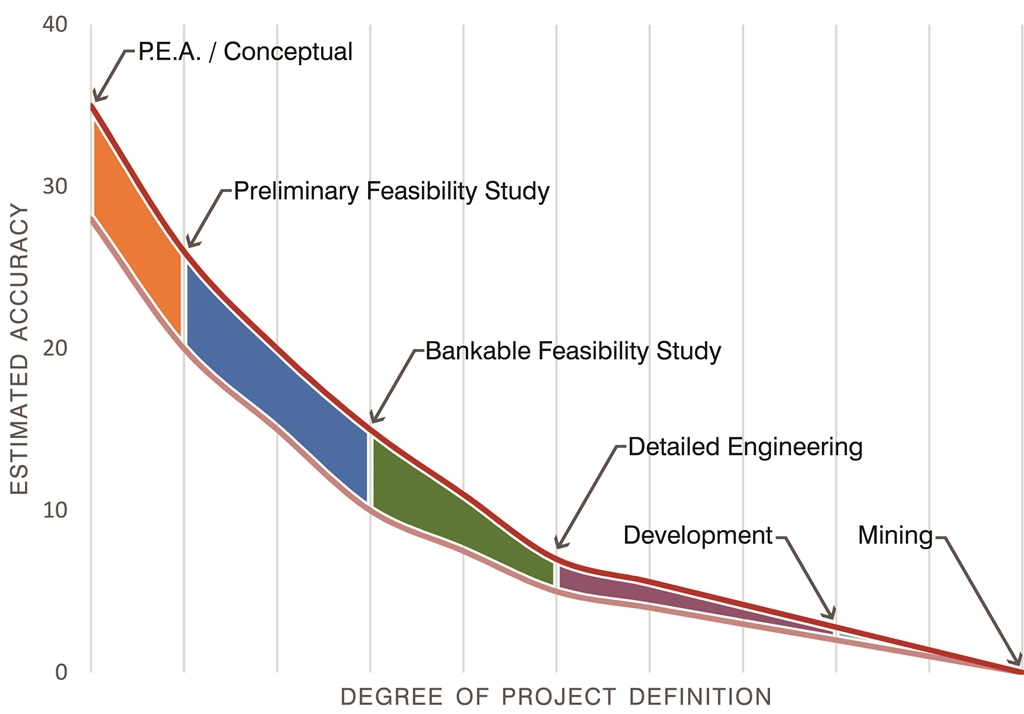

Study stages for a mining project

In order to demonstrate that a project will be economic or not, the operator needs to produce a report using defensible costings that demonstrate a viable mining and processing route. The report is normally produced according to industry reporting guidelines and the costings and design become more accurate as it progresses from PEA, PFS, BFS and Detailed Engineering to Development and Mining as above.

How your PEA Becomes a Mine Starter

The first level of reporting after the Conceptual Study is the Preliminary Economic Assessment (PEA). This is usually the first report that is produced according to reporting code guidelines.

It is the least detailed study and gives general concepts about geology, project location, ore grades, ore and waste tonnages, previous Mineral Resource and Reserve statements, a proposed metallurgical process route either conceptual or based on preliminary studies, and a cash flow forecast.

This type of report costs less money than other more detailed studies and its objective is to inform investors and the operator whether the project is likely to be economic or not and how much additional work is required in order to do a more detailed report.

What Wikipedia Doesn’t Tell You about Pre-Feasibility Studies

The PFS is a far more detailed report than the PEA and it contains the bulk of the work required for a FS. In a PFS there will be a Resource and Reserve statement, metallurgical test work to demonstrate a viable process route, detailed costings for each aspect of the proposed mining and processing routes and preliminary engineering design. The cash flow forecast is far more detailed than in a PEA and opex has a much higher level of accuracy.

Why Large-scale Mining Needs Bankable Feasibility Studies

This is the final level of study which will be used as a document that will be audited by banks and other lending sources to provide project financing (capex). Capex can typically range from as little as $20 million up to $450 million and in some large projects requires over $6 billion.

Lenders need to be satisfied the FS covers all financial, geological and engineering aspects of the project. It is often known as a bankable or definitive feasibility study (BFS/DFS) and it is required to pass the lenders audit before project financing is given.

Once it has passed audit by lenders and if the project is economic in current market conditions, the next stage is agreement of lending terms followed by staged drawdown to fund mine development.

Why Mineral Resource Statements are Crucial to Your Project

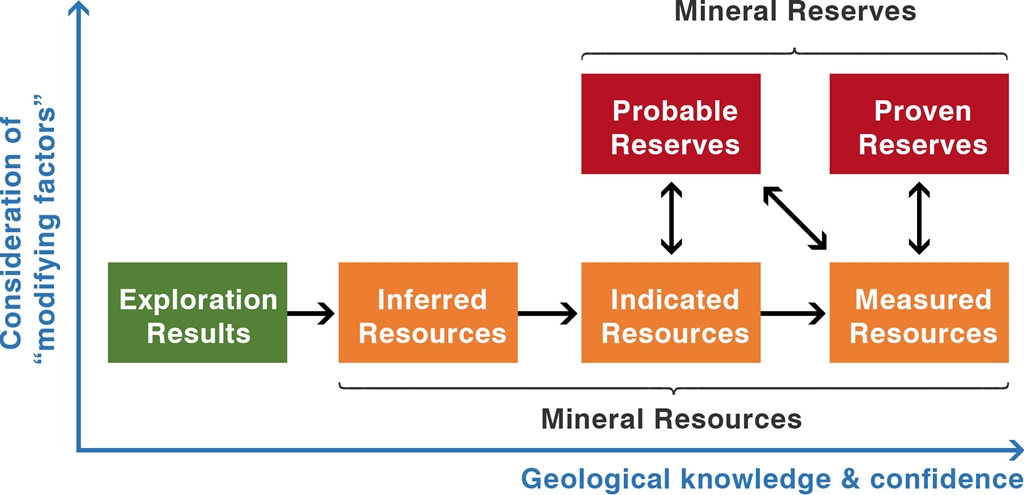

A Mineral Resource is a mineral concentration which is known, estimated and interpreted from specific geological evidence and knowledge and with reasonable prospects for economic extraction.

Mineral Resources are classified as Inferred, Indicated & Measured, with increasing levels of geological knowledge and confidence.

Mineral Reserves are mineral resources that by applying modifying factors such as costs are shown to be economically feasible for extraction. Mineral Reserves are either Probable Reserves or Proved Reserves. A Probable Reserve is the part of Indicated, and in some circumstances, Measured Mineral Resources that can be mined in an economically viable fashion. These Reserves are calculated in a feasibility study.

Mineral Resources and Reserves are reported according to guidelines issued by the following organizations in the west:

- The Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves http://www.jorc.org/docs/jorc_code2012.pdf

- The South African Mineral Resource Committee (SAMREC) Working Group http://www.samcode.co.za/downloads/SAMREC2009.pdf

- National Instrument NI-43101 Standards of Disclosure for Mineral Projects (Canada) http://web.cim.org/standards/documents/Block484_Doc111.pdf

Mineral resource confidence

In Russia and China resources are reported according to different standards and are state approved. So, resources established under these systems will require additional work for them to qualify under the above codes and vice versa.

Investors usually look for resources and reserve statements that have been signed off by a “Qualified Person”, defined as such according to the above guidelines.

The purpose of these reporting codes for resource statements is to try to ensure that misleading, erroneous or fraudulent information relating to mineral properties is not published and promoted to investors and on the stock exchanges.

Comments are closed.