Mineral Economics 101: How Mining Investors Get Rich

“I think for any small business that’s boot strapped the overwhelming challenge initially is getting to positive cash flow”

– John Mackey

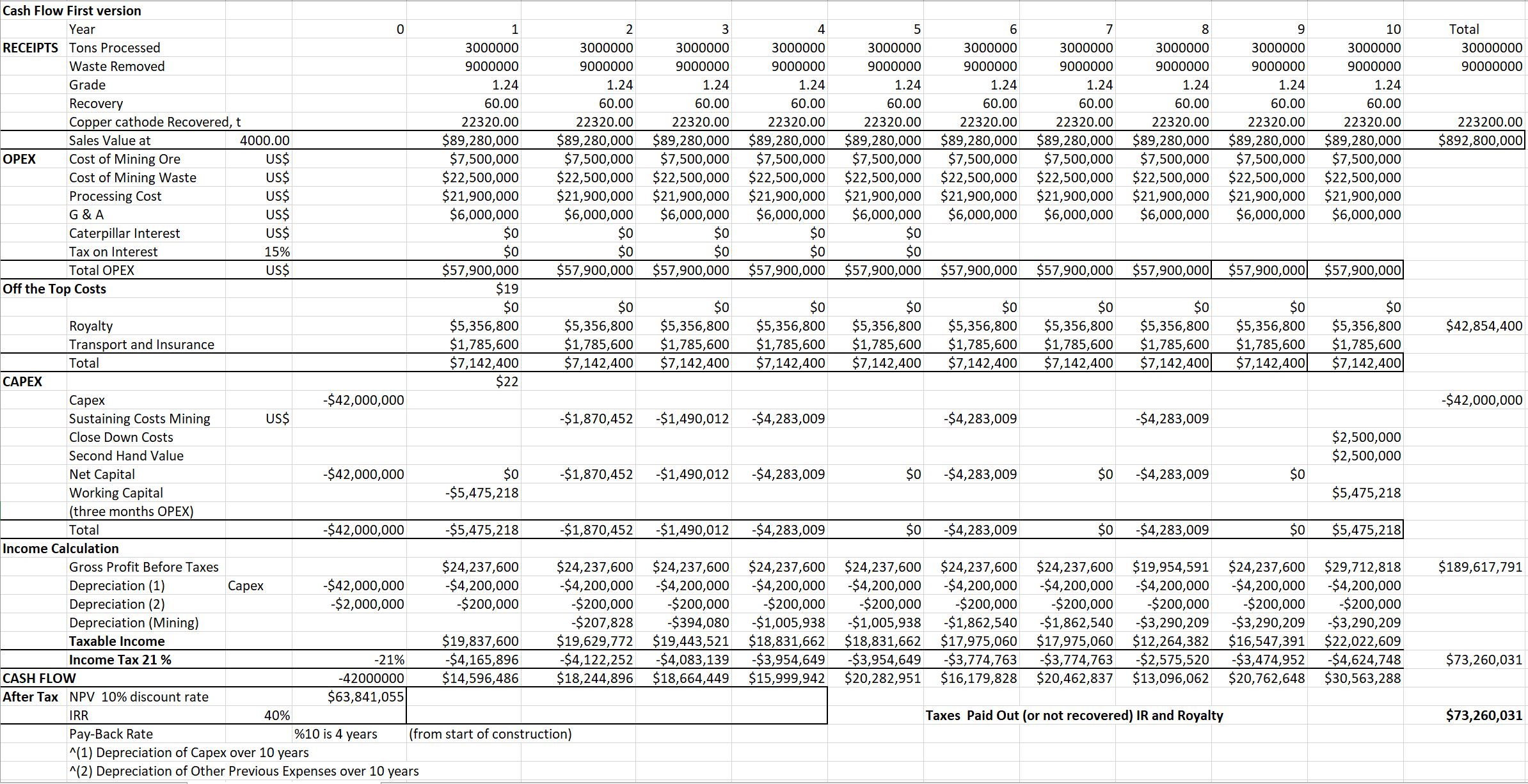

One needs to understand the fundamentals of what makes a mine profitable. Any one of the factors mentioned in this eBook can make a mine profitable or conversely make it a “money pit”. The earlier one gets a handle on each of these factors, the better informed one will be about the potential profitability of the venture. This is done by putting together a cashflow forecast such as the one below.

All the figures, such as the capex, opex, grade, tonnage and mining rate, are put into a spreadsheet template and the result is the cashflow forecast. Mining projects are usually evaluated in terms of their IRR and NPV.

An attractive small to mid-size mining project in 2016 will have an IRR of 20-120%, an NPV in the range of $50m to $2Bn and a capex of $20m to $2Bn. Ideally total opex after taxes and royalties plus capital repayments should be less than 80% of the intrinsic value of the ore.

Typical cash-flow for an unnamed project at PEA stage

Why Mine-ability Matters

Costs are directly proportional to the time and energy required to remove the ore (mining) and separate it from the waste (mineral processing).

What Your Mum Never Told You about Stripping Ratios

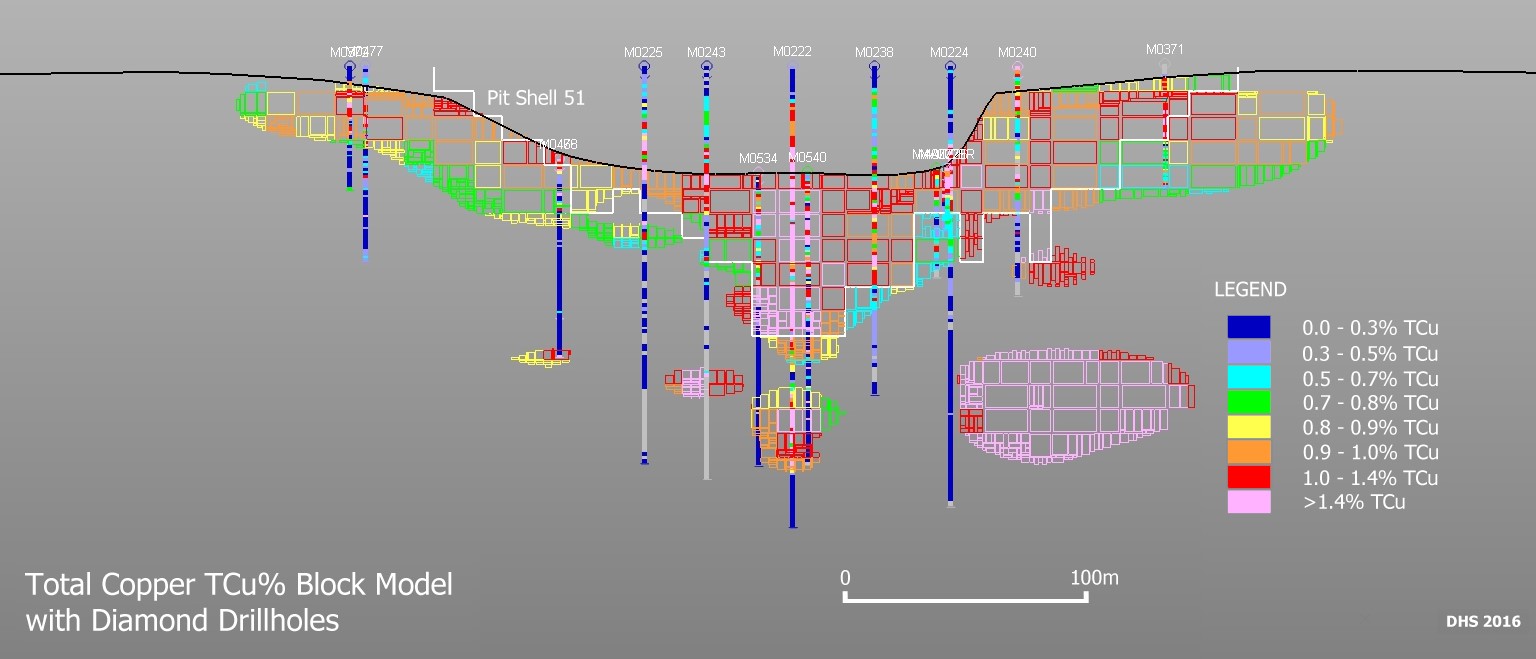

The stripping ratio is the amount of waste material that needs to be mined in an open pit relative to the amount of ore that is mined. So, if you need to remove two tonnes of waste for each tonne of ore, the stripping ratio is 2:1. At Mimbula copper project in Zambia (below), the stripping ratio is expected to be 1.12. The lower the stripping ratio the better because you will be wasting less time and energy on removing waste rock.

[/vc_column_text]

Open-pit design for Mimbula copper project in Zambia

3 Facts about Open Pit Mining That makes it a No-brainier

Open pit mining is generally cheaper per tonne of rock than underground mining because it requires less engineering, and little or no artificial ground support.

Standard mining equipment like excavators, trucks and mechanical screens are used. The mining rate is generally faster and cheaper because of economies of scale compared to underground mining.

The Hinda Project in the Republic of Congo where I worked in 2011 is one of the World’s largest undeveloped phosphate projects with the Mineral Resource comprising continuous mineralization over 20 km of strike.

Underground Mining: Why it’s still relevant

The advantage of underground mining is that mining can be focused on narrow veins thus less waste from wall rocks.

The waste to ore ratio tends to be smaller so it is ideal for narrow, high value ore deposits like gold veins.

The equipment tends to be smaller, sometimes automated and more specialized therefore possibly more expensive.

The disadvantages are the high cost of mining, high capex for the specialized equipment and mine development, slower mining rate, the cost of rock support, pumping water out, and ventilation.

When I arrived at Asacha in 2002 the underground was accessed via a Soviet era exploration adit. The current throughput at Asacha gold mine is approximately 200,000 tonnes of ore per annum, using the sub-level shrinkage method, supplying ore to a Carbon-In-Leach (CIL) plant, to produce around 80,000 Oz of gold and 160,000 Oz of silver per annum. The planned mine life was 7 years but that has since been extended by exploration with the Eastern Zone discovery.

The Complete Beginners Guide to Rock Mechanics

Competent rocks will stand up well and provide their own support.

Where artificial support is required it can be provided by using rolled steel joists to support tunnelling (previous picture). Very incompetent rocks must be supported every meter by jacks and concrete and are costly and slow to mine

Dilution occurs when waste rock dilutes the ore; this particularly happens when waste rock is incompetent.

Rock competency is an important factor because it decides your mining rate, your percentage ore dilution and your cost per tonne of ore as a component of opex

The Idiots Guide to Site Infrastructure

Every mine will need to have electricity and water supply, office and worker accommodation, roads for site access, warehouses for mining equipment and consumables, vehicle repair shops, fuel storage tanks, a laboratory, canteen facilities, etc.

All of this will need to be built from scratch especially in remote locations where whole towns are known spring up around a new mine.

In general, the more remote the location the more infrastructure that must be put on site and the higher the Capex.

At Asacha where I worked in Russia, the biggest hurdle was the remoteness of the deposit. It was cut-off for 4 months of the year by snowfall and then by river torrents and mud.

This problem was solved by upgrading a 65km long access road with bridges and culverts, and by building the plant in summer, and by having most of the supplies brought in during summer months and by using helicopter support in winter (in between blizzards). All these factors added to the capex and opex.

At Veduga in Siberia where I worked, even though we proved up a 3-million-ounce gold ore body, the lack of access to enough power held up significant mine development for several years. Had this deposit been located next to enough grid power supply it would have become a significant gold mine.

The 3 Critical Factors Affecting Process-ability

After the ore has been mined, the most valuable materials need to be concentrated and made ready for sale and transport. The critical factor is how can the valuable element, say gold for example, be separated from the ore?

Typically, gold ore is mined at between 1 and 20 grams of gold per tonne of ore. So, if each tonne of rock contains one gram of gold, that is 1g of gold that is required to be liberated as economically as possible from each 1 tonne of ore mined.

In order to produce gold bars for sale the gold needs to be removed from the run of mine ore.

Every type of ore has got distinct chemical and physical properties and some ores are easier to treat than others. The idea is to remove pure gold from the ore.

However sometimes gold is trapped in the lattices of other minerals such as pyrite and even though the concentrations might be high, the cost of separating gold from pyrite can be very high too. So, one always looks for ores that can be easily processed, and the desired element concentrated at a low cost. A typical gold ore process route is shown below.

If gold or copper can be heap leached, that is thrown in a big pile and acid

poured over it for a period of 3-12 months, and the gold or copper is dissolved passively as a pregnant solution; this is a low cost treatment method. However, this form of treatment also has lower recoveries than if you were to do an agitated or a tank leach.

The capex is lower for heap leach, but the recoveries may not be as good as higher cost methods such as tank leaching. So, the 3 critical factors affecting processing costs are:

- The mineralogy of the ore.

- How easy it is to remove the desired elements from the undesired ones.

- The engineering, design and chemical treatment that is required to do this.

Many projects become economic when a new or cheaper treatment method is established via test work, while other projects become sub-economic when it is found that conventional treatment methods do not work.

The Best Alternative to Wasting Money on New Processing Methods

In general, one prefers to use ore treatment methods that are well established and have been in use for decades such as heap leach and electro-winning.

Engineers and investors are more comfortable with processing methods that are well established and have stood the test of time.

Typically, at this stage, laboratory scale and pilot test work are undertaken to design and propose a viable processing method.

Ideally, design templates adapted from other projects can be applied after test work confirms that the proposed processing method works.

In gold and copper processing, ores that are associated with oxides will require different treatment methods to those that are associated with sulphides.

For example, copper sulphide ores such as chalcopyrite often require floatation or specialized leaching conditions. In comparison oxides such as malachite require leaching in cold dilute sulphuric acid.

Experimental Processing: The World’s Worst Ever Mining Investment

If a particular element is tricky to liberate from the ore, and if the ore responds badly to established processing techniques, then a new mineral processing method may have to developed, or an established method will need to be adapted to treat this type of material.

However, this can turn out to be costly because the results are often unknown at the outset and the project becomes high risk.

Metal Price: The One Critical Factor that Affects All Mining Investments

The current metal price is the biggest single factor that will decide if a mine is economic or not.

For example, when gold prices are high, you can mine low grade ore even at high cost. You can afford to strip large amounts of waste and still make a profit.

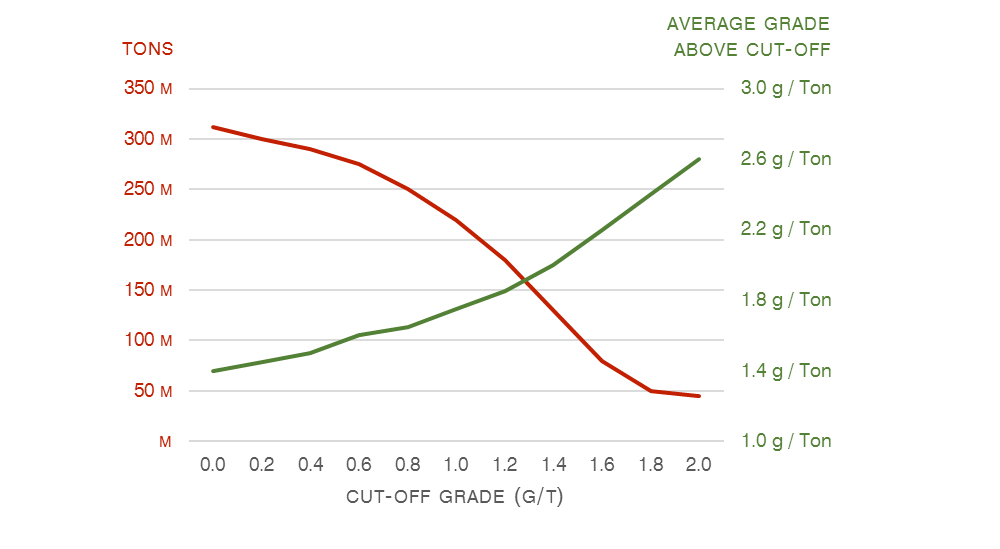

When gold prices are low, low grade ore becomes sub-economic and therefore your cut-off grade rises.

The cut-off grade is the ore grade at which it is profitable to mine, process and sell refined product at a profit. It is calculated from all-inclusive costs and metal prices and it affects the amount of ore mined and metal produced.

The formula is simple: cut-off grade = all-inclusive cost/% metal recovery/price per unit of metal.

Grade tonnage curve for an unnamed gold project

3 Facts about Capex That Will Scare You

When putting together a cash flow forecast for a mine the capex is the investment that is required to establish the mine, site infrastructure, site access and processing facilities.

I worked at Mount Muro Gold mine in Borneo where the capital expenditure during construction phase included shipping much of the equipment and fuel up the River Barito on barges. Rivers in Borneo provide much more reliable access than roads which trend to be washed away in rainy season and filled with potholes in dry season.

Capex is the initial investment. It is the amount of financing that is required to get the mine underway and it is generally financed by debt.

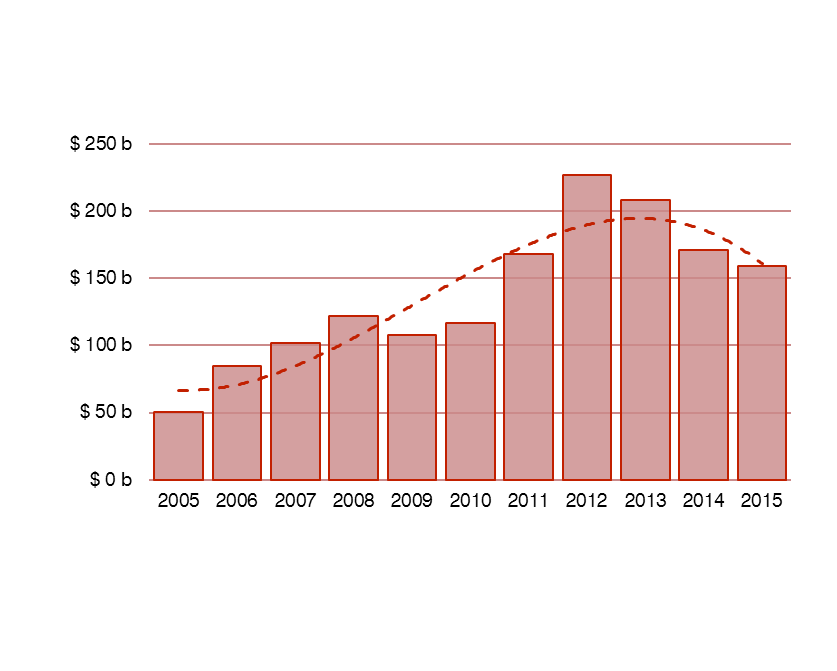

Worldwide capital expenditure from SNL Mining & Metals

- A report by SNL Metals and Mining finds that Capex spending on projects has more than trebled since 2005 (above). This is due to higher capital costs, lower ore grades and more huge mine developments requiring multi-billion-dollar capex to produce economies of scale.

- The total capital spending across all mining companies has declined by around $70 billion since the 2012 peak to just over $150 billion forecast for 2015 reflecting decline in demand for metals.

- First Quantum’s Cobre Panama project requires over $6.6 billion in capex to develop the copper mine.

Why Opex is Hotter than Julia Roberts

The opex is another critical factor that will decide if the mine will be economic. The opex per tonne of ore must be lower than the intrinsic value of each tonne of ore.

For example, if your ore contains 1% copper then at a $5,000 per tonne copper price your ore is worth $50 per tonne based on contained metal (that is $5,000 x 1% = $50). Therefore, as a rule of thumb, you want your opex to be less than $50 per tonne in order to make a profit.

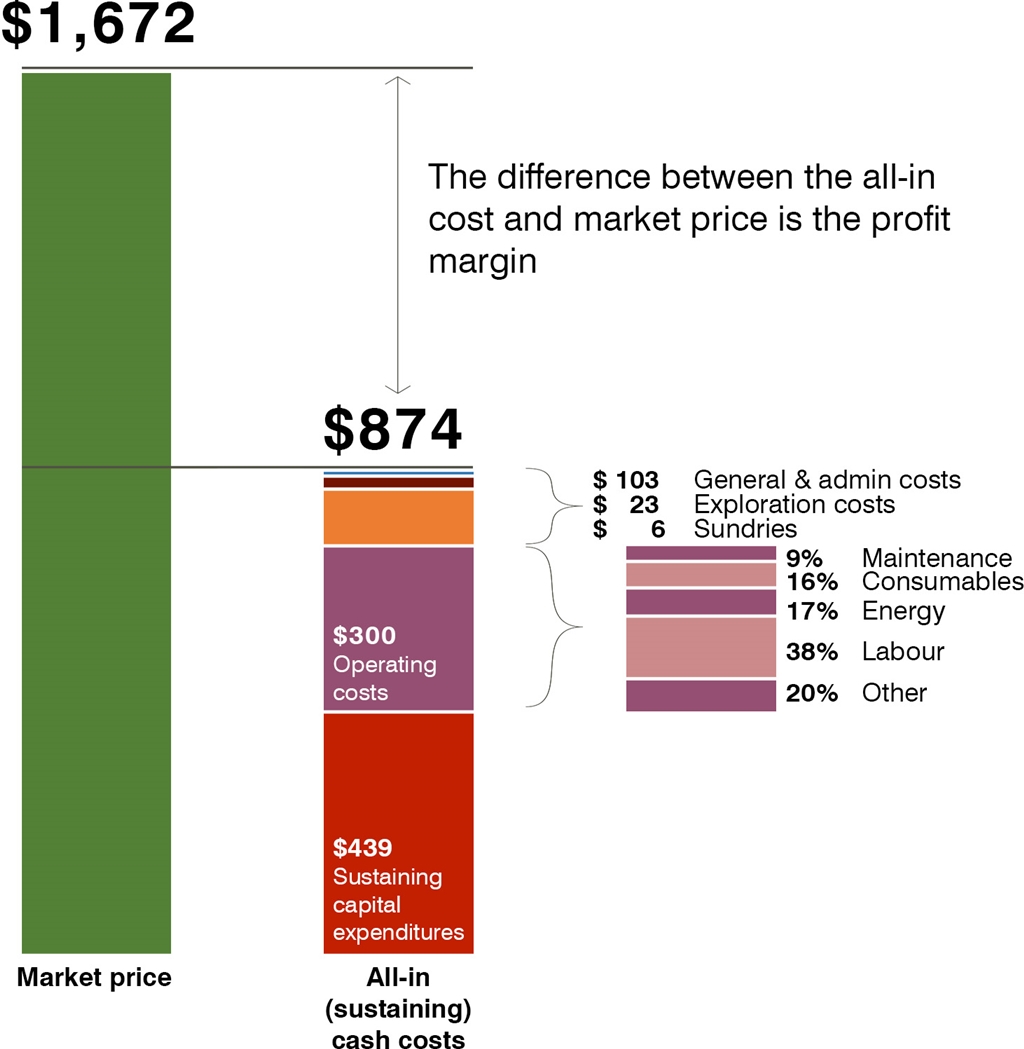

Operating costs for an unnamed gold mine

You also need to repay capex (usually funded by debt) out of cashflow so you need to deduct debt repayments plus any taxes and royalties too from your value of ore per tonne. In the example above the opex per ounce of gold is compared to the gold price.

Royalties and Taxes: 2 Things That Could Kill Your Investment

“This impossible to be sure of anything but Death and Taxes.”

– Christopher Bullock

What Christopher Bullock said about death and taxes applies equally to mines as well as to people.

Mineral Royalties are regular payments, usually based on the volume or price of minerals extracted, made by mining enterprises to national states or other owners of mineral resources as consideration for the right to exploit mineral resources.

One thing that can mean certain death to a mining project before it even starts or while it is running is a high royalty. However, an astutely applied royalty agreement could allow the operator to acquire a project in return for giving away a percentage of future earnings to the original owner or pay back the capex that financed development as a percentage of production.

Royalties are often agreed with financiers in the early stages of a project, before production begins in order to finance it. Governments usually apply a royalty and a corporation tax.

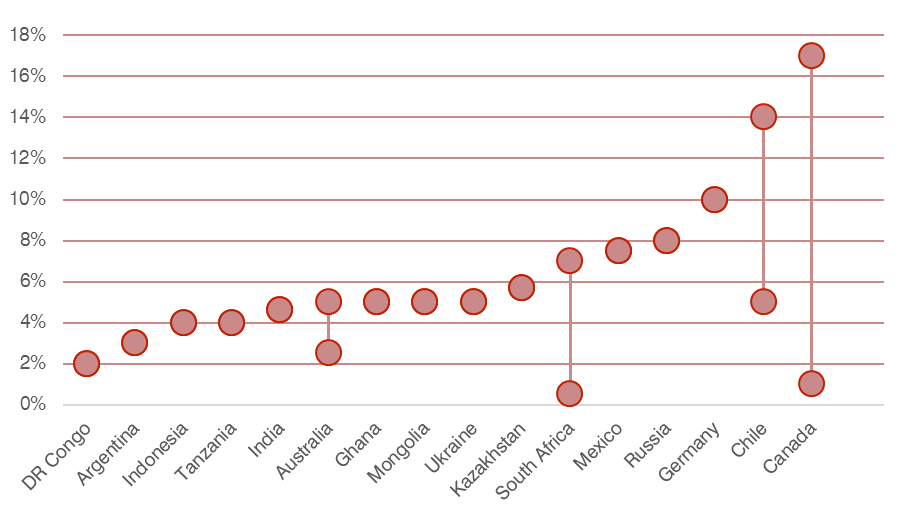

Royalties in various countries worldwide

If the government, debt royalties and ownership royalties are too high it will slice off most of the profit before it reaches you and could kill the project. The graphic above illustrates the royalties in various mining countries.

Comments are closed.