Mineral Project Location: The 10 Most Important Facts

“There are three things that matter in property: location, location, location”

– Lord Harold Samuel

Mining is a multinational industry therefore there are 10 essential facts to consider when deciding which mineral exploration locations will increase your success rate and reduce your investment risk.

The first 7 facts concern national jurisdiction, security and infrastructure and the next 3 are geological factors.

7 Little-Known Facts about Jurisdiction

“Asia is entertainment, Europe is a dream, America imprisonment and the Rest a nightmare.”

– Santosh Kalwar

Mines are located throughout the world and geology ignores national boundaries but these boundaries play an important role in individual project economics.

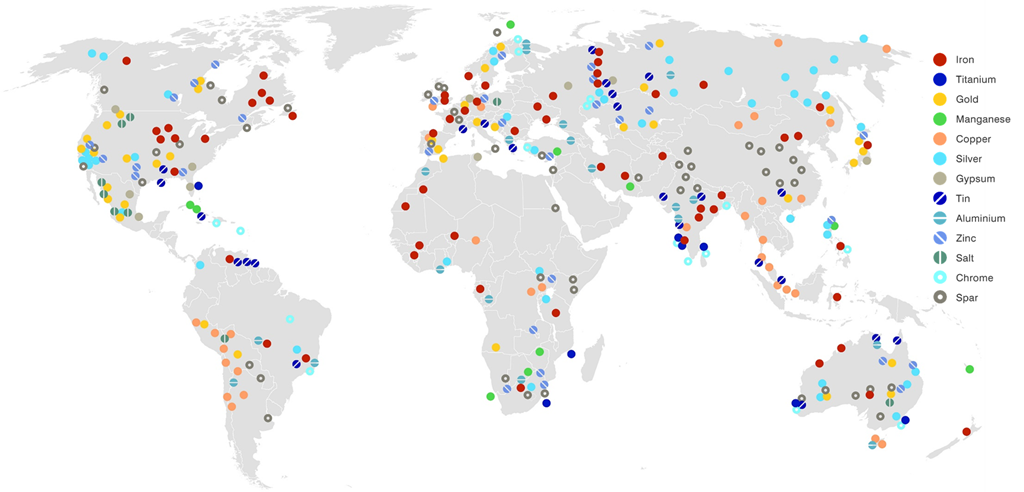

Figure 2 Locations of active mines in the world

I have explored for minerals in many countries and it is usually a combination of available mineral deposits combined with a window of political and economic opportunity that brought us there.

When I went to Russia in 2001 with start-up company Trans-Siberian Gold, Russia was chosen by the company founder Jocelyn Waller because of its rich gold endowment and the perception of an improving security and investment climate.

Since 2013 I have been working in Zambia which we recognized as a country with a mining culture, it is English speaking, and it has the richest sediment-hosted copper district in the world. I was invited to go there by a Zambian businessman who had recognized the opportunities to get foreign funding into a newly diversified ownership scene.

Spain where I worked briefly in 2011 is part of the EU and is therefore it has the advantage of infrastructure and lifestyle as well as historic mining. Indonesia is the province of giant mines and is an economically proven geological belt.

The mineral wealth of West Africa, where I also worked in 2011 is well known and deposits are becoming accessible through improvements in infrastructure and investment climate.

I was invited to work in Indonesia in 2007 by a mining entrepreneur who recognized the potential to acquire undervalued assets a decade after the Asian crisis.

When deciding whether to invest in a jurisdiction, you need to consider the following 7 location factors.

Location Fact 1: The Mining Code Cheat Sheet

The bottom line is that you need to have security of tenure.

There is no point investing in a project that will be taken from you by a local operator when it starts to look attractive. Is the mining code in the country in which the project is located favorable to the operator and how well is it enforced?

Ideally the licence application and tendering process is open and transparent. In the best mining and exploration destinations one can download application forms, pay the application fee and get a mineral exploration licence within a matter of months. In the worst performing countries, you must cultivate close relationships with government officials or wait years for regulatory approval before you start work.

A country’s mining code (law) also tells the operator how much they must pay annually in government fees in order to retain their licences. There is usually a minimum expenditure and you want to make sure that’s as low as possible for you to be able to retain the mineral licence without having to spend too much on exploration and drilling.

For example, where my current company’s licenses are held in Zambia the prospecting license confers the right to prospect for any mineral over any size of area for two years with relinquishments of at least 50% of the area at each stage.

The prospecting license obliges the license holder to adhere to agreed program of work, financial commitment and training of Zambians. The holder of a prospecting is entitled to convert that to a Mining license. The duration of the Large-Scale Mining License is 25 years renewable for 25 years.

Location Fact 2: Why a Country’s Perception Means Getting Investments in Record Time

“The optimist sees the doughnut; the pessimist sees the hole”

― Oscar Wilde

Some countries are “hot” in mining investment terms. That is, if a discovery has been made there recently, and if it contains a commodity that is also “hot”, or if it has a good reputation for mining, then investors will be much more inclined to take a risk there.

Some countries have good reputations for mining based on a successful production record over the past 50-100 years; these include Chile, China, Australia, Peru, USA, and Zambia.

When I arrived in Russia in early 2001, a period of chaos and under-investment had followed privatisation of state mining assets which had taken place under Boris Yeltsin during the 1990’s. In investors eyes Russia was a risky, and economic instability and security of tenure was an issue.

In 2000, with Vladimir Putin recently installed rule of law was being applied and a period of economic stability followed. This enabled the start-up company I was with, Trans-Siberian Gold (TSG), to attract international investors who saw that good mining assets in Russia were cheap and that a new period of stability beckoned. TSG was able to list on the AIM market in London in 2005 with its Russian assets.

TSG is still a publicly traded company in London producing gold from a very rich gold mine at Asacha in Kamchatka.

Indonesia, where I worked in the 1990’s at Mount Muro Gold Mine and again in the 2000’s with another start-up Sumatra Copper and Gold was a very popular destination for mining and exploration companies.

Mining companies were attracted by rich porphyry copper and epithermal gold projects such as those at Batu Hijau, Kelian and Mount Muro and the perception there were many more to be discovered.

The Contract of Work (CoW) system of mineral licence allocation was centrally administered in Jakarta and companies and the civil service knew the rules.

However, I was there when President Suharto lost power in 1998, and in time centralised control of mining code was lost to the regions, overlapping claims to mineral licences became commonplace and international investors fled.

Lately I have been evaluating licences in Zambia on behalf of my company Moxico Resources plc. Zambia is historically the 8th largest copper producing country on earth. It has a rich history of copper and cobalt mining dating back to the 1890’s.

Major companies departed when vast licence allocations were broken up in the early 2000’s but this has spelled opportunity both for junior exploration companies like my present company, Moxico Resources and local Zambians alike to get patches of very valuable ground in the Central African Copperbelt.

Location Fact 3: Why Mining Culture Matters

“Culture drives great results”

– Jack Welch

Is there a culture of mining in the country you’re investing, exploring and mining in? If there is, there will be a willingness from the legislative and administrative apparatus to support mining projects and new mine developments.

As mining brings revenues to the coffers of the government through taxes and employment is provided in the mining industry, then in turn the government increases it support for development of new mines and mining culture grows. There will also be a flow through of environmental approvals for mining projects.

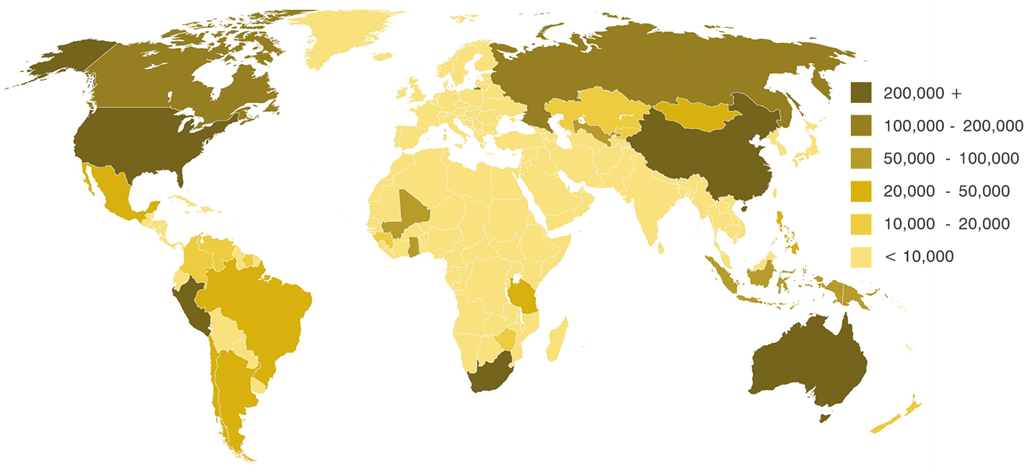

If you were to invest in projects in countries where there is no mining culture the project might face local opposition, delays and possible failure unrelated to the actual mineral value. The graphic below shows the world’s premier gold producing nations, in ounces.

Figure 3 World gold production by country

The exceptions are where a country or new government has a stated aim to become a new mineral producing destination and enacts legislation favorable to mining investment. In recent years governments of certain West African countries such as Cameroon, Ivory Coast and Liberia enabled favorable legislation in order to attract new foreign mining investment with varying degrees of success.

My current company has a copper project in the heart of the Zambian Copperbelt. When it comes to getting investment, investors immediately recognize Zambia is a mining country, with 70% of the country’s export earnings generated from copper.

Location Fact 4: Three Government Danger Signs

“Asia is entertainment, Europe is a dream, America is imprisonment and the Rest is a nightmare.”

– Santosh Kalwar

Ideally you want your projects to be in a country where the government supports mining with favorable tax laws.

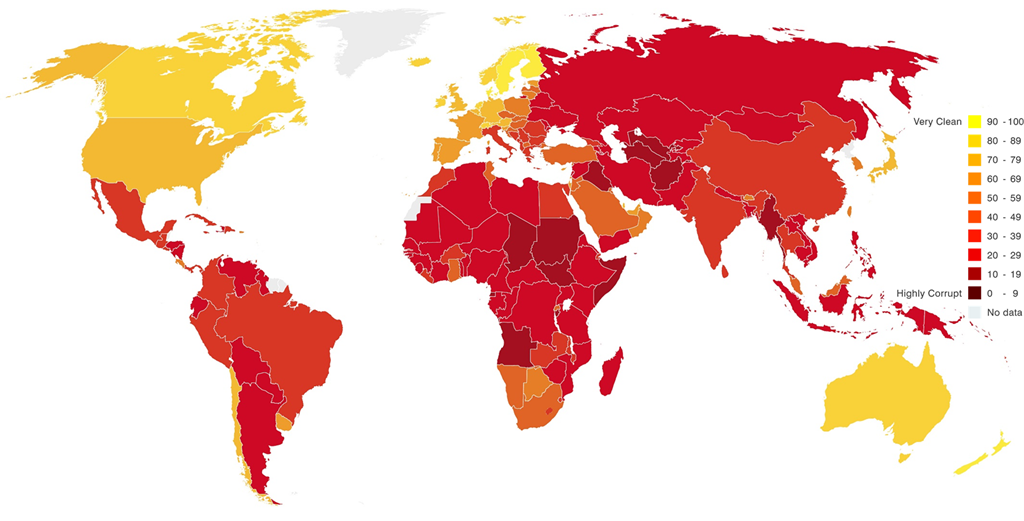

Figure 4 Corruption Perception Index from Transparency International

Is there a culture of corruption? Ideally you want to work somewhere that is low on the international corruption index. Unfortunately, many developing countries where mining projects are located have higher levels of corruption.

The 3 danger signs that bribery occurs in mining are surveys carried out by Transparency International from the judicial, healthcare and construction sectors. The Corruption Perceptions Index ranks countries/territories based on how corrupt a country’s public sector is perceived to be.

The reports focus on how judicial corruption, corruption in the health sector and corruption in the construction sector undermine economic development and where these occur there is bound to be corruption in the mining sector.

Location Fact 5: The Seven Scariest Mineral Exploration Destinations

“Life is either a daring adventure, or nothing.”

– Helen Keller

Is there lawlessness?

You want to be somewhere where transport can move freely without being hijacked. In certain countries, regional chiefs’ erect roadblocks and demands tariffs for moving goods along the road network.

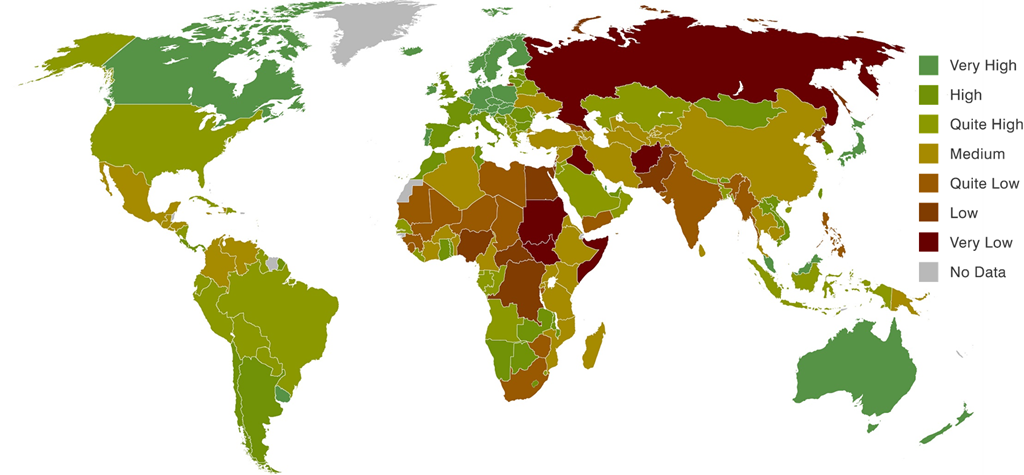

According to the 2015 Global Peace Index the 7 scariest mining destinations are Nigeria (ranked 149th out of 163 countries), Russia (151st), DRC (152nd), Ukraine (156th), Yemen (158th), Afghanistan (160th) and South Sudan (162nd).

You will ideally want to be somewhere with a stable democracy, where there is no armed insurrection and no civil war or disobedience, labour strikes, illegal miners or banditry.

Figure 5 Global Peace Index

The dangers can be mitigated. Certain parts of even the worst performing

countries are peaceful to operate in. When I was in Russia with TSG in 2001-2005 the greatest dangers were the amount of vodka and caviar that we had to consume during meetings with local geologists and departmental officials, as well as close encounters with grizzly bears in Siberia and Kamchatka!

Location Fact 6: Transporting Minerals – Why Camels are better than Goats

Ideally there will be paved roads, running within a few kilometres of the mining project. Roads are essential for getting equipment onto site during mine development and for getting ores and materials out. You could have a large deposit in the middle of nowhere, in the Yukon or in Siberia for example, and it could be sub economic to mine because all transport links and infrastructure will need to be put in place and included in the capex.

In contrast you could have a much smaller deposit in the centre of an industrialised area, and it might be economic to mine. For example, in the Zambian Copperbelt where I work, many small-scale operators make a living by mining and trucking ore to treatment plants on existing roads.

At Veduga in Russia, transport was not a problem because there was a good all-weather road 300km to Krasnoyarsk however power-supply for the proposed processing plant was an issue and, in the end, stymied the project’s development. In the same country, at Asacha, the Gorely caldera has to be crossed in order to supply the mine.

In winter the caldera gets over 15 metres of snow cover so the 150km from Petropavlosk-Kamchatskiy to the mine site can take 3 days by truck and has taken convoys up to 7 days during blizzards. In summer the same dirt road can be travelled in 4 hours.

Barruecopardo where I did a resource model optimization in 2011, is in the western part of the European Union and access is a breeze. Follow the CL-517 highway 90km westwards from the beautiful medieval city of Salamanca to the mine site, it is about an hour’s drive.

At the giant Hinda phosphate deposit in the Republic of Congo where I started the first drilling campaign in 2011, a Chinese highway links the coast at Point Noir 37km to the mine site and beyond. The road is lined part of the way with logging trucks carrying hardwoods from the virgin forests of the country’s interior to sawmills, which was a very distressing sight. However, the access is very good.

The ideal destination for your mine already has access roads. However, if the worst comes to the worst, transporting minerals across a desert on camels is faster than trying to transport them through mountains on goats.

Location Fact 7: Processing Facilities – What Every Mining Project Really Needs

Ideally your project will be next to existing treatment facilities. That means it is in a belt that hosts similar deposits that have already been developed. I used to work in the Peruvian Andes where there is a whole string of producing copper mines.

If you can toll treat your ore you will not have to pay the capital costs for developing your own processing plant, unless your project justifies the Capex. Also, there will be lots of infrastructure, skilled employees, and mining supplies and contractors available locally.

Powerful Geological Terrain Advice for Investors

Location Fact 8: Why Target Minerals Matter – Find Out

“Truth, like gold, is to be obtained not by its growth, but by washing away from it all that is not gold”

– Leo Tolstoy

Asacha where I worked in Kamchatka, Russia, is an epithermal gold deposit located on the Pacific Ring of Fire. The other project I worked on in Russia, Veduga is in the Yenisei Gold Belt. These are both geological terrains of different ages that both host a long and established history of gold production. Gold has its historic production areas: one ideally wants to be investing where there are current and historic gold mines.

If one wants copper porphyries, you should be where there are existing copper porphyry mines.

That is in Northern Chile, Western USA, the Philippines and Indonesia, Eastern Australia and Central Asia as in the figure below.

Figure 6 Worldwide porphyry and epithermal belts

Many smart investors go where there are already world class belts and terrains of the type of mineral they are targeting.

While discoveries can be made in new areas, if you go outside of these proven areas you are taking on much higher exploration and country risks.

Location fact 9: How to Cheat at Exploration and Get Away with It

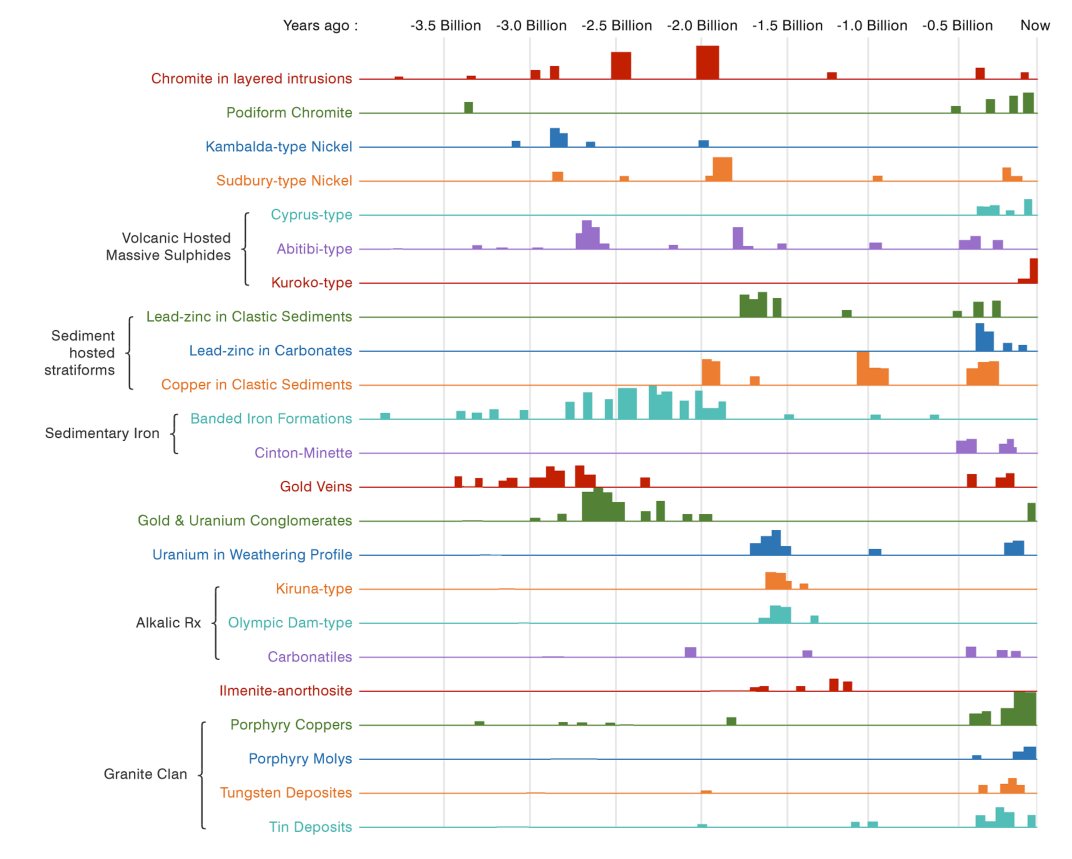

Most porphyry copper deposits are dated from less than 500 million years ago. This is because the earth was undergoing geological and chemical processes in certain locations during these epochs which favoured these metals being deposited and not eroded.

Figure 7 Abundance of different mineralization styles through geological tim

Similarly, high grade, shear-hosted gold deposits were deposited in greenstones 2.5-3.5 billion years ago. If you want the best chance for your project to become a mine, you should be selecting deposits that are in rocks of the optimum age for the types of metals you are targeting. Looking for deposits in rocks of previously unexplored epochs is much higher risk than sticking to well-known epochs.

The copper deposits of the Central African Copperbelt (such as Mimbula) are hosted by terrestrial and shallow marine sedimentary rocks deposited 880-550 million years ago. The copperbelt is also host to around 40% of the world’s cobalt concentration and almost 50% of copper hosted in sedimentary deposits. If you are searching for sedimentary-hosted copper deposits, then looking in rocks of the right age is one way to cut your exploration risk.

Location Fact 10: Why Proximity to Other Deposits Matters

“Gold is where you find it”

– Old prospectors saying

World class deposits occur in strings, terrains and belts. There are minor deposits dotted between them. This is because geological processes occur along faults and plate margins.

Where Moxico’s projects are now in the Central African Copperbelt, there are a string of world class copper mines.

You want to be investing in a project that occurs along a line of other deposits and is preferentially located between at least two major deposits. This is because the geological processes that determine mineral concentration occur in certain specific locations.

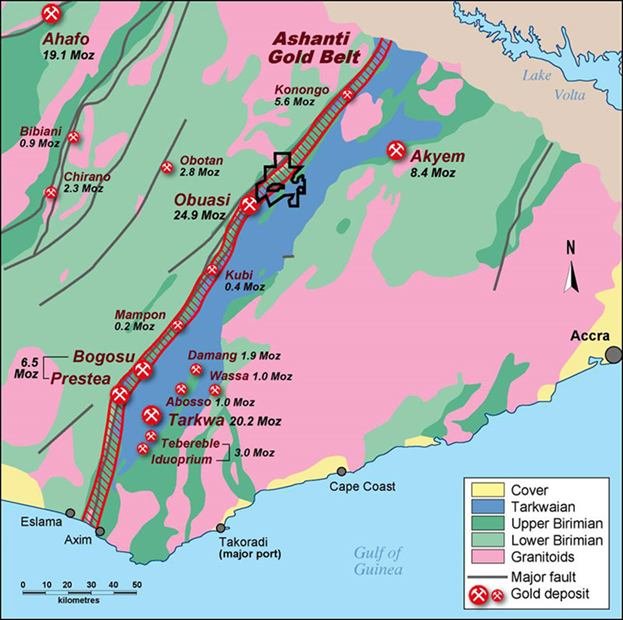

This means that mineral deposits form in proximity to one another as in the Ashanti Goldfield in Ghana above which contains 6 world class mines alongside many smaller mines and deposits, hosting a combined total of over 70 million ounces of gold. The formation of mineral deposits requires the right combination of heat source, fluid pathways, fluid mixing, metals content, host rocks, and changes to pressure and temperature.

Figure 8 The Ashanti Gold Field in Ghana – example of a world class gold province

Comments are closed.