4 Ways to Simplify Fundraising Seed Funding Shortcuts – The Easy Way

“Start selling to customers before you even have a product.”

– Mike Belsito

If you see an opportunity to start a new company, and have some good projects lined up, the easiest way to initiate getting funding is to first put a certain amount of your own time (and money if possible) into establishing a viable proposal.

Once you have an attractive proposal then you approach your mining industry contacts and friends and family and ask them to invest in you and in your plans. To gain maximum traction you also need to leverage their contacts. If you can get one or two key players on board to support and promote your ideas, their contacts may follow.

It is easier to do this if you already have a credible track record in the mining industry and if you have contacts with money to invest.

When I started working with Trans-Siberian Gold (TSG) in 2001, seed funding was initially provided by the founder. Once he had a viable proposal, he invited his mining contacts, his friends and family and business contacts to invest, together with a few of my friends and family too.

The founder of TSG was a mining entrepreneur with a successful track record having previously started a gold mine in south-east Asia.

He needed a geologist to evaluate mineral projects in Russia, so he approached me to go to Russia and help identify and evaluate the many available projects.

I had finished working on Mount Muro gold mine in Indonesia two years previously and I was at the time enhancing my surfing skills in Donegal, in the northwest of Ireland. I had been living an idyllic life for two years, and I was super fit, but I had burnt through all the money I had earned in Indonesia and needed a new opportunity. The mining game I was familiar with was my best bet so when I was approached to go to Russia I jumped at the chance. I worked for a nominal salary and expenses plus shares and options in the new venture.

In Russia I worked together with a Russian geologist Dr Boris Guzman to evaluate approximately 20 projects. From these we picked out a handful of deposits with the best combinations of grade and tonnages. From these, Dr Guzman used his local contacts to make inquiries to find out which owners were willing and able to do a deal.

Once we knew there were good projects available and deals to be done, the founder approached seed investors with a written proposal explaining that there was an opportunity available in Russia to pick up undervalued projects with established resources at the bottom of the market in a turning economy.

The gold price in 2001 was close to rock bottom but that would work in our favour when negotiating acquisitions.

The reduced technical risk of picking up projects in Russia is that may deposits had had a huge amount of state-funded exploration work already completed on them.

This work would have cost many millions of dollars to have acquired but the data was available for anyone with the right contacts to evaluate.

The founder explained to investors in his proposal how we were going to get the projects under our control, carry out feasibility studies and work towards an Initial Public Offering at which point investors would own shares at a higher share price in a publicly traded company.

There were about 30 original shareholders in TSG providing amounts ranging from $4,000 to $30,000 each. Seed funders provided funding to the order of $500,000 and that enabled us to do an initial phase of work in Russia, mostly data mining, and resource evaluation.

At seed round stage founders usually retain at least 50% of the equity of the company.

In return they are required to do all of the work to grow the company, raise additional funds and add value to the projects and thus grow the value of the company and provide a return to investors in the form of increased share price.

Seed funding followed by further funding rounds enabled TSG to sign up and pay for option and JV agreements with license holders for “brownfield” mineral deposits in Russia.

Later funding rounds allowed the company to do deals for the deposits that we had identified.

As Russia emerged from state control of all assets into an era of privatization these projects had had a significant amount of exploration completed including drilling but had not been mined.

What they lacked was the capital and will to develop them and that is what TSG’s management and shareholders provided.

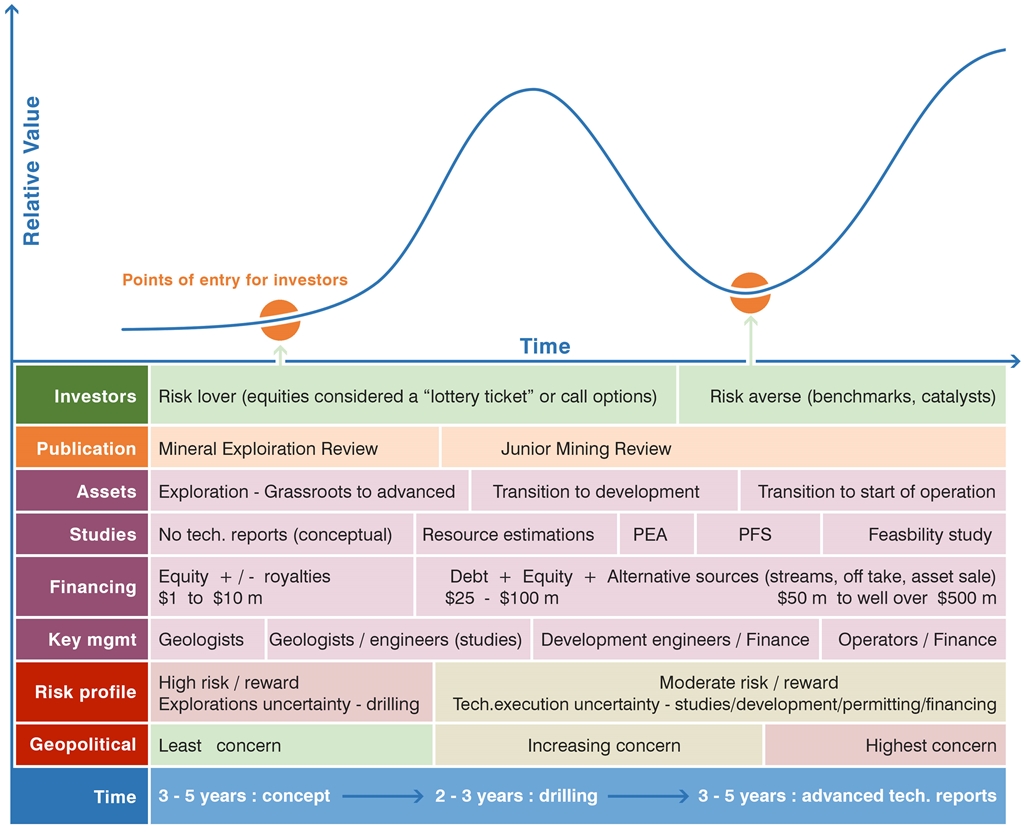

Time versus relative value in the investment cycle of a mining company

After careful review of what projects were available in the whole of Russia, TSG acquired two main gold projects, Asacha in Kamchatka and Veduga in North Yenisei Region. These were acquired through joint ventures and purchase of equity in the licence holding companies. Once we had control of the projects, we started exploration work including trenching, pitting, soil sampling and drilling. This exploration work lead onto completion of scoping studies, PFS’s and bankable FS’s. The entire period from company foundation to IPO was 5 years. Seed investors who sold out on IPO made 6 times return on their investment.

One of these gold projects, (Asacha) has been developed by TSG into a high-grade underground gold-silver mine and it is currently producing 50,000 ounces of gold equivalent per annum.

Another (Veduga) had its resources increased from under 1 million ounces to over 3 million ounces by using systematic exploration including the first reverse circulation drilling in Russia. Veduga was sold on to Anglo Gold Ashanti and it is now reputedly a producing gold mine in the hands of a Russian company.

The way that seed funding is organized is that shares in the new company are sold to seed investors. The seed investors benefit from low share prices and company valuation and therefore they will achieve higher returns. This is only right because they take the risk of funding such an early-stage enterprise (as in the graph above). However, if seed funders do not follow through their equity interest in each subsequent funding round their percentage of the company will get diluted.

TSG’s and the founder’s strength were to spot the opportunity if abundant undeveloped Mineral Resources in Russia at a time of post-privatisation. The critical point was to identify an economic asset at the pre-mining stage.

Shareholders receive their returns when the company is sold on to a much larger company or when the company lists on the stock exchange. Usually seed investors will expect to get 5 to 10 times return on investment.

In the UK many seed investors take advantage of SEIS and EIS schemes to offset 30-50% of their seed investments against income tax.

Cracking the Private Equity Code

“Venture capital is about capturing the value between the start-up phase and the public company phase”

– Fred Wilson

Once the company has used its seed capital to acquire mining or exploration permits in its name, or at least have signed option agreements or JV agreements with licence holders, additional funds in the order of $3 to $10 million will be required to do exploration including possibly drilling and sampling.

The idea is to add value by adding resources and adding confidence to the project and to the financial model.

A PE Group, sometimes known as a Venture Capital or VC group will look to invest at the Points of Entry, shown in the figure above and may well pay for the resource upgrade and the PFS and FS reports.

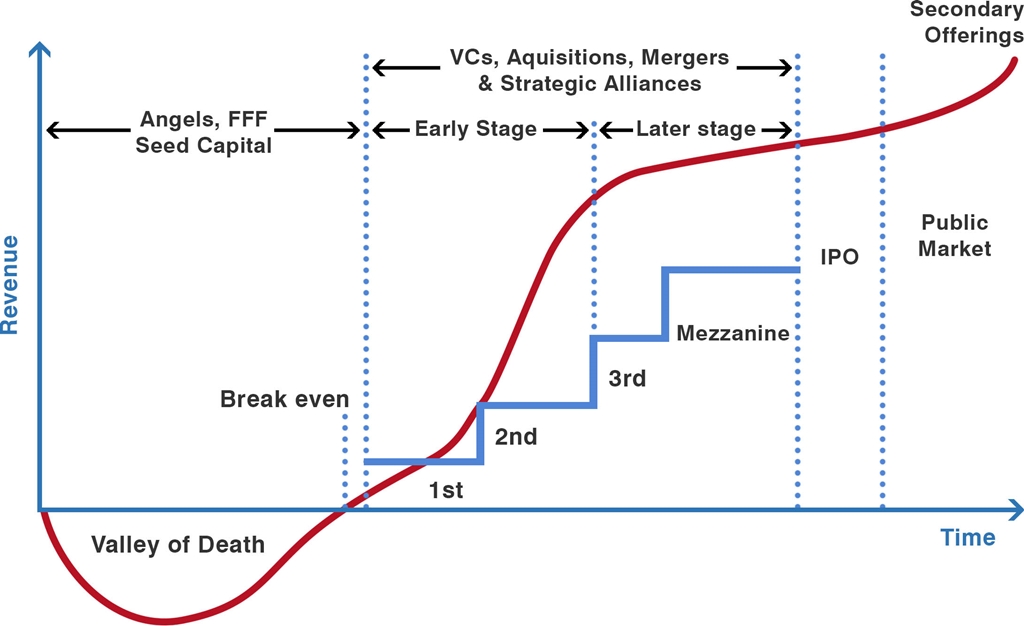

If a PE Group makes its investment at the 1st, 2nd, 3rd or Mezzanine Financing stages shown in the graph below then it will look to make at least 3 and ideally 10 times it a return on investment at IPO. So, if a PE Group invests $5m at this stage it will be looking for the company to have attained a market capitalization of $15 to $50 million at IPO.

The way that a company increases its market capitalization is by increasing the value of its projects and reducing their technical risk. The value of a company is usually equated at pre-production stage to the NPV of its projects

Funding stages for a mining company

PE funds could look to sell out upon IPO but putting so many shares on the market at this stage could hurt company value so many will hold on for a longer-term investment of 5-10 years. Another way PE Groups make money is they often look to arrange project financing as the project develops. So not only are they involved at an equity level they are also either involved directly in financing the debt side of the project or in commissions for arranging the debt. The sweet spot for debt financing for PE groups is in the range of $30-$60m.

When a PE Group is evaluating a prospective mining company, they scrutinize all the factors outlined here, namely Mineral Resource, mineability, process-ability, capex, opex, cashflow forecast, commodity, management and location.

They won’t necessarily take the case presented by the company and its independent consultants in their reports at face value and they may use their own metrics.

The PE Fund evaluates many such projects and probably invests in 1% or less of them. So, they are looking for projects that tick all their own boxes in terms of location, commodity and potential gains.

One Word: Equity

“Equity capital is expensive. Every time you do a raise, you dilute”

– Fred Wilson

The other way for a start-up mining company to gain momentum is through selling equity to a mid-size or major mining company, usually through an earn-in, share swap or cash deal.

This will enable the start-up company to carry out work on its projects and give the new investor a stake in the outcome. The new investor can either take equity in the parent company or take a stake in one of the projects. This dilutes current shareholders but provides liquidity which is a lifeline to project exploration and development.

In 2004 Anglogold Ashanti bought a stake in TSG’s Veduga gold project in Russia, which we had taken from 900,000 ounces of gold to over 3M ounces. This gave TSG the cash to do further work on that project and Anglogold to buy into a potential mine at pre-mining stage.

The Secret behind Debt

“When a man is in love or in debt, someone else has the advantage”

– Bill Balance

Debt financing comes in last, right before mining. Lenders usually put in the most money and have the lowest risk profile therefore almost all the project risk must be eliminated before a lender will put up project financing.

Debt financing is agreed only after a bankable feasibility study (BFS) has been completed by independent engineering firm and audited by the bank’s technical advisors.

For a typical small mine, debt financing is in the range of anything from $10 million to $250 million.

For larger financing arrangements up to several billion, the debt is spread across a range of lenders and financial structures including hedging, royalties and forward sales.

Comments are closed.